BPC Event on Geopolitics of Shale Gas

On July 25th, the Bipartisan Policy Center hosted its second installment of its ongoing series on unconventional oil and gas developments in the U.S. The first was on the geopolitical implications of the tight oil boom, and this second event covered the geopolitical implications of the surge in U.S. shale gas production – something that ASP has written extensively on.

On July 25th, the Bipartisan Policy Center hosted its second installment of its ongoing series on unconventional oil and gas developments in the U.S. The first was on the geopolitical implications of the tight oil boom, and this second event covered the geopolitical implications of the surge in U.S. shale gas production – something that ASP has written extensively on.

Several of the panels arrived at similar conclusions that ASP wrote about in our March report, “The Geopolitical Implications of U.S. LNG Exports.” For example, the rapid rise in shale gas production in recent years diverted much of the global LNG supply that was originally destined for U.S. ports. With more LNG moving around, importing regions – Europe and Asia in particular – experienced a benefit in terms of price and sources of supply. And that occurred without the U.S. actually exporting significant volumes of natural gas.

If the U.S. allows LNG exports to continue move forward – and the administration seems inclined to do so – greater U.S. LNG will erode oil-linked contracts in Asia. This will lower Asian LNG prices and provide greater liquidity to markets there.

Yet, there is also evidence that the volume of LNG exports from the U.S. will be limited. There is a window of opportunity in the coming years that may not last. Natural gas prices are extraordinarily low in the U.S., but very high elsewhere, particularly in Asia. Gas companies will only have a limited time to take advantage of this arbitrage opportunity until the window slams shut. Natural gas prices could climb in the U.S., especially if more is used in the electric power sector. And prices could decline in Asia as new supplies come online (from Australia, Malaysia, and others) and Japan considers a return to nuclear power. To read more on these geopolitical implications, check out ASP’s report here.

The panelists touched only briefly on the subject of climate change. David Montgomery of NERA Economic Consulting discussed his thoughts on the net effects of greater U.S. LNG exports on greenhouse gas emissions. He noted that exports will displace dirtier fuel sources abroad, such as coal or even fuel oil in the electric power sector. On the other hand, more demand for LNG from exports will mean greater domestic production (which will increase emissions) and a boost to coal (as natural gas gets more expensive). On balance, he thinks it’s a wash, but more study is needed.

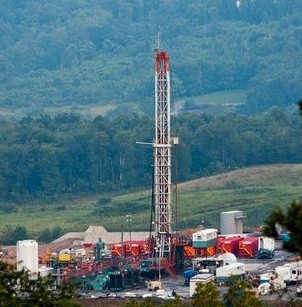

Senator Wyden concluded the event by discussing his openness to federal involvement in the hydraulic fracturing process. He suggested leaving regulation on the underground aspects of fracking to the states, while allowing the federal government to set standards on transparency and the disclosure of chemicals. While he hinted that there was some bipartisan support for the idea, he emphasized that discussions were early on in the process.

[…] BPC Event on Geopolitics of Shale Gas Nicholas Cunningham On July 25th, the Bipartisan Policy Center hosted its second installment of its ongoing series on unconventional oil and gas developments in the U.S. The first was on the geopolitical implications of the tight oil boom, and this second event covered the geopolitical implications of the surge in U.S. shale gas production – something that ASP has written extensively on. […]

[…] BPC Event on Geopolitics of Shale Gas […]