Africa – Risk in Egypt: A Fixed Price on Uncertainty

By Dante Disparte, Managing Director of Clements Insurance and member of ASP’s Consensus and Business Council for American Security

It is hard to ignore Egypt. Not only is it the heart and cultural center of the Arab world, it is also its most populous country, with 86 million people, and a key North African market that cannot be overlooked – locally, regionally or internationally.

It is hard to ignore Egypt. Not only is it the heart and cultural center of the Arab world, it is also its most populous country, with 86 million people, and a key North African market that cannot be overlooked – locally, regionally or internationally.

While the recent headlines have been dominated by grim scenes of popular uprisings, a military coup and, most recently, a resurgence of terrorism in the Sinai Peninsula at the hands of Ansar Bait al-Maqdis, nonetheless Egypt’s long term prospects remain hopeful.

The first step in this direction, however, depends very much on how the administration of the newly-elected Abdel Fattah al-Sisi handles stabilizing risk and uncertainty.

If countries can be too-big-to-fail, Egypt is it for the North African region.

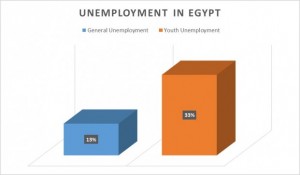

Its long term geo-strategic relations with the U.S. have been strained. The detente with Israel remains in balance and so many investors, local and international, remain skittish about near term prospects for stability. Even with an electoral outcome favoring al-Sisi, his prospects to remain in power and Egypt’s prospects to return to growth and quell the disquiet among the Egyptian public depends on one thing – jobs. With youth unemployment at 33% and general unemployment at 13%, the Egyptian economy has to grow between 6% and 7% to absorb the 700,000 new entrants in the labor force each year, targeting 8% unemployment according to economists at The Arab Stabilization Plan. At the same time private sector development needs to be spurred, as highlighted in the Carnegie Middle East Center’s report, The Private Sector in Post Revolution Egypt. Accounting for 63% of Egypt’s GPD and 70% of its employment, Egypt’s economic pyramid has a wide base.

Its long term geo-strategic relations with the U.S. have been strained. The detente with Israel remains in balance and so many investors, local and international, remain skittish about near term prospects for stability. Even with an electoral outcome favoring al-Sisi, his prospects to remain in power and Egypt’s prospects to return to growth and quell the disquiet among the Egyptian public depends on one thing – jobs. With youth unemployment at 33% and general unemployment at 13%, the Egyptian economy has to grow between 6% and 7% to absorb the 700,000 new entrants in the labor force each year, targeting 8% unemployment according to economists at The Arab Stabilization Plan. At the same time private sector development needs to be spurred, as highlighted in the Carnegie Middle East Center’s report, The Private Sector in Post Revolution Egypt. Accounting for 63% of Egypt’s GPD and 70% of its employment, Egypt’s economic pyramid has a wide base.

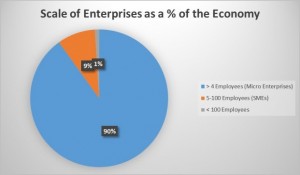

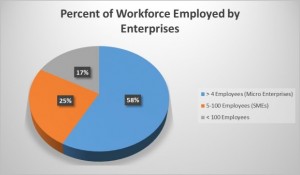

Micro enterprises with fewer than 4 employees account for 91% of Egyptian enterprises employing 58% of the workforce. The remaining 9% of Egyptian enterprises are small to medium-sized (SMEs), representing 8% or the total with 5 to 100 employees accounting for 25% of the workforce.

Micro enterprises with fewer than 4 employees account for 91% of Egyptian enterprises employing 58% of the workforce. The remaining 9% of Egyptian enterprises are small to medium-sized (SMEs), representing 8% or the total with 5 to 100 employees accounting for 25% of the workforce.

The top 1% of firms in the Egyptian economy are large with more than 100 employees representing approximately 17% of the workforce according to the Carnegie report.

As in many countries, the share of value or riches captured by these enterprises is inversely related to the employment pyramid, with the top 1% of firms commanding the lion’s share of Egypt’s economic wealth. Not only are micro enterprises and SMEs squeezed by the burden from above, they are squeezed as the engines of job creation and starved of the needed capital to expand their businesses while raising living standards for the average Egyptian.

Fewer than 10% of Egyptians have a bank account and less than 20% of Egyptian firms have access to credit or the capital markets, which is another challenge to the private sector identified by the Carnegie report. Favoring a cash economy means that the majority of business decisions are measured in days, particularly for SMEs.

Fewer than 10% of Egyptians have a bank account and less than 20% of Egyptian firms have access to credit or the capital markets, which is another challenge to the private sector identified by the Carnegie report. Favoring a cash economy means that the majority of business decisions are measured in days, particularly for SMEs.

This short-termism is compounded by Egypt’s ever present military, which not only dominates political life it also crowds out economic activity by commanding between 20% and 40% of the economy according to some estimates.

The difference between risk and uncertainty is that risk can be measured and factored into most investment decisions.

Indeed, without risk, there would be no so-called ‘upside.’ This holds true for investing in stock markets as for investing in countries. Uncertainty on the other hand cannot be measured and it is what causes panics, flights of capital, bank runs and general paralysis. The same holds true for the local and international state of investment in Egypt according recent figures.

Post-revolution foreign direct investment (FDI) inflows of $1.5 billion were nearly netted out entirely by capital outflows, in a flight to safety, of $1.2 billion. Similarly domestic investments by Egypt’s largest firms were halved from their pre-revolution levels down to $18.3 billion between 2011 and 2012 according to leading regional experts, Ibrahim Saif and Ahmed Farouk Ghoneim. Add a young, urban and jobless population to this equation and you have an incendiary mix that is both Egypt’s greatest asset and liability.

Yet, all is not lost. Internationally-backed Egyptian firms, Such as Carbon Holdings led by Basil El-Baz, are leading by example and, critically, capitalizing on these uncertain times by investing heavily in a down market.

According to The World Bank,Gazelles, the moniker used to describe fast growing, high-impact entrepreneurs like Mr. El-Baz, are a major part of the solution for both job creation and raising living standards in Egypt. Approximately 5% to 10% of these firms deliver between 50% and 80% of job creation.

According to The World Bank,Gazelles, the moniker used to describe fast growing, high-impact entrepreneurs like Mr. El-Baz, are a major part of the solution for both job creation and raising living standards in Egypt. Approximately 5% to 10% of these firms deliver between 50% and 80% of job creation.

Similarly these Gazelles when they spring into action they are keenly aware of risks and how to hedge them. Much like how Mr. El-Baz turned to international players such as the Export-Important Bank of the United States for financing and guarantees, agencies such as OPIC and private insurers offer a range of solutions to put a fixed price on uncertainty.

Against this standard, many developing and frontier markets move from being too risky to investment grade with the advent of solutions such as political risk insurance, which can offer a vital hedge against a host of worst-case scenarios.

For practical purposes, international firms operating in Egypt will need to consider insuring their tangible assets with property insurance valued in the same currency as their operating income. For example, a European firm denominated in Euros will not only have an exposure to country risk in Egypt, they will also face certain risks relating to a currency mismatch.

This pernicious effect often renders many insurance policies of little value at the time of a claim and subject asset valuations to currency volatility. Additionally, firms will want to ensure that they are covered for the range of worst-case-scenarios outlined above. Political risk insurance covering the investments, forced abandonment of property, currency inconvertibility and various forms of contract frustration are available from private insurers or agencies, such as OPIC.

Covering the “people behind the P&L” is of course of paramount importance, however, less common but highly advised forms of coverage include political evacuation and salary continuation insurance. This policy class not only affords international staff the semblance of stability by guaranteeing that a portion of their earnings continue, they also afford insured firms the peace of mind of having professional assistance with the evacuation process.

Covering the “people behind the P&L” is of course of paramount importance, however, less common but highly advised forms of coverage include political evacuation and salary continuation insurance. This policy class not only affords international staff the semblance of stability by guaranteeing that a portion of their earnings continue, they also afford insured firms the peace of mind of having professional assistance with the evacuation process.

While the toll of Egypt’s revolution is still being tallied, remaining on the sidelines as an investor, domestically and internationally, may only compound Egypt’s woes and translate into lost opportunities in a competitive global market.

[…] Africa – Risk in Egypt: A Fixed Price on Uncertainty Consensus for American Security If countries can be too-big-to-fail, Egypt is it for the North Africa region. Not only is it the heart and cultural center of the Arab World, it is also the most populous country, with 86 million people and a key north African market that cannot be overlooked. […]

[…] posted on American Security Project by Dante Disparte, Managing Director of Clements Insurance and member of ASP’s […]