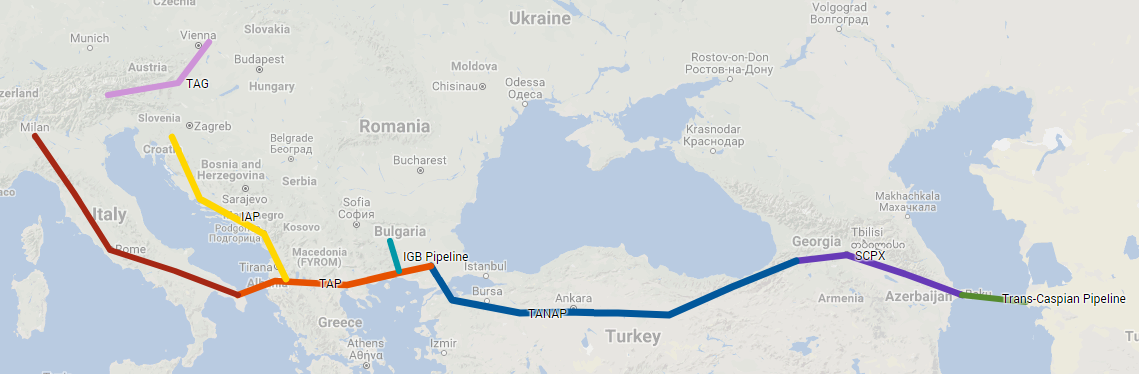

Approximate routes of the Southern Gas Corridor and extension pipelines

Approximate routes of the Southern Gas Corridor and extension pipelines

European Energy Diversification and the Potential of the Southern Gas Corridor

In May 2014, the European Commission released its Energy Security Strategy, which aims to ensure a “stable and abundant supply of energy” for the European Union. One of the main long term goals is the diversification of supply, to protect against a disruption or cutoff. Poland received its first shipment of American LNG this past summer, renewable energy investment is a main focus, and for some, like Germany, coal is still a major source of energy production. Another option for diversification is the Southern Gas Corridor. The corridor is made up of three pipeline projects: the South Caucuses Pipeline (SCPX) that runs through Azerbaijan and Georgia, the Trans Anatolian Pipeline (TANAP) that runs through Turkey, and the Trans Adriatic Pipeline (TAP) that will stretch across Greece, Albania, and Italy. An interconnector will also link from Greece to Bulgaria. When combined, the Southern Gas Corridor will cover some 3,500 kilometers and represents a total investment of roughly US$40 billion.

The gas will originate in Azerbaijan and the massive Shah Denz field in the Caspian Sea, with first gas expected to travel from the Caspian to Europe in late 2018. Shah Denz is one of the largest gas developments in the world. Stage 1 development of the field produces 9 billion cubic meters per year (bcma) of gas. Stage 2 will result in an additional 6 bcma of gas to Turkey and a further 10 bcma to Europe. In 2016, Italy imported 24.69 bcm of natural gas from Gazprom. This gas flowing from Shah Denz through the Southern Gas Corridor could potentially be used to decrease these imports, should Italy choose to reduce their energy relationship with Russia.

There are plans to both expand the volume of gas that will flow and the physical delivery infrastructure to move Azeri gas deeper into the European continent. With Turkmenistan cut off from its two largest markets, Iran and Russia, the country is looking for somewhere to send its natural gas. A potential pipeline across the Caspian Sea, the Trans-Caspian Pipeline, linking the country to Azerbaijan and the Southern Gas Corridor, was long opposed by Russia. However, Turkmenistan is seeing the potential for its gas to be sold in Europe for a higher price than it currently gets in Asian markets, participating in the Southern Corridor would move Turkmenistan away from a reliance on Russia-owned pipelines.

TAP will be connected to the Italian natural gas grid, operated by Snam Rete Gas, allowing for gas to reach other European countries through Italian “exit points.” Gas flowing through TAP can also reach Austria and other Central European countries through the gas hub in Baumgarten, Austria through the Trans Austria Gas (TAG) pipeline. In addition, South Eastern Europe could see Azeri gas with a connection to the planned Ionian Adriatic Pipeline (IAP), which would run through Montenegro and Albania, and could bring gas to the Balkans. Both TAP and IAP have received funding or special status from the EU.

Nord Stream 2, a proposed pipeline that would run off the coast of the Baltic countries from Russia to Germany, has proved controversial. At a time when there are those in Europe who want to move away from Russian gas, Germany sees this pipeline as a supply guarantee even as gas production in EU countries declines. Countries in Eastern Europe, however, are concerned with Russia’s use of gas for geopolitical ends. Countries like Poland and the Czech Republic that rely exclusively on Russia for gas worry about potential supply disruptions. The Southern Gas Corridor could provide a viable option, along with American LNG, to move away from complete dependence on one source of gas. The United States has long advocated for its allies have market choice. The future of American policy remains unclear – recent sanctions against Russia could harm Nord Stream 2 – but the United States has long supported the Southern Gas Corridor and will also continue to promote American LNG as an option. With a stated goal of “speaking with one voice” on external energy policy, it seems that the European Union may have to figure out how to balance the desire of some to engage with Russia, while others seek to move away from the gas giant.