The Impact of American Post-Pandemic Economic Recovery on the Global Economy

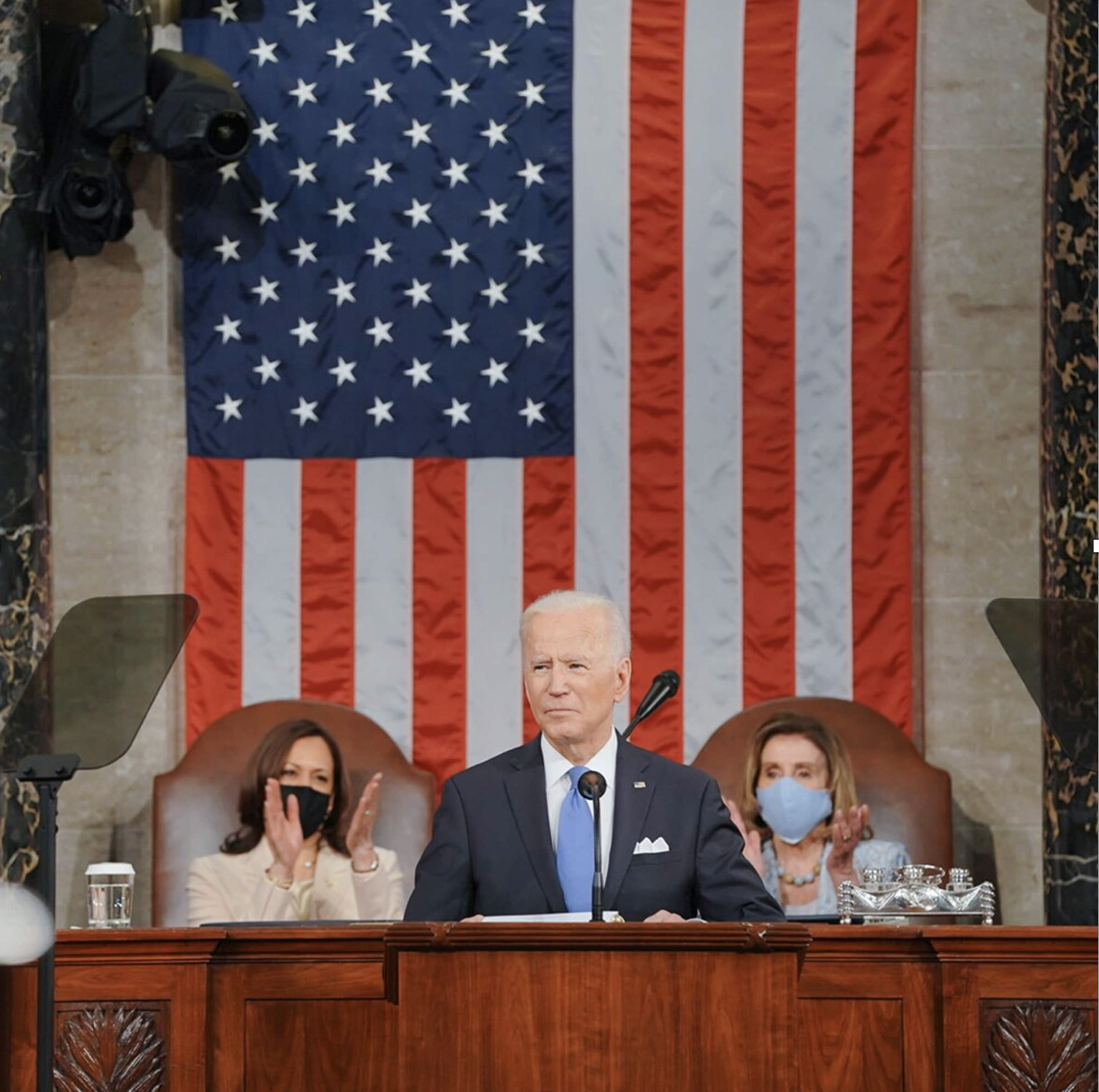

The emergence of COVID-19 has dramatically altered the economies of all countries in the international system; however, it is clear that not all countries have been able to rebound at the same pace. U.S. resiliency with the rapid rollout of vaccines and $1.9 trillion coronavirus relief bill has gotten the country back on track in many ways. This is in contrast to some European counterparts and other developing countries where the vaccine rollout has been more delayed and relief spending plans aren’t on the same scale.

Among other advanced economies, the U.S. is predicted to surpass its pre-COVID GDP levels while many others will not reach the equivalent until 2022. China already returned to previous levels in 2020 while many others are not projected to until 2023. Reported by the Wall Street Journal in March, the U.S. is expected to make a bigger contribution to global growth than China if both continue to grow at roughly the same rate. Comparatively, the U.S. spending program alone is anticipated to increase output 0.5 percentage points in Japan, China and the eurozone over the next 12 months, and by up to 1 percentage point in Canada and Mexico. As the US economy accounts for approximately a quarter of world GDP, it has a much larger role to play in restabilizing the global economy than other advanced industrial economies.

As economic recoveries vary across countries and sectors, it is important that U.S. remains cognizant of the impact of its rapid recovery on global supply chains and countries that are struggling to meet these new consumer demands.

Although the American Rescue Plan has provided a crucial first step in offering relief to millions of Americans and building up vital public health infrastructures, it is important that we extend that momentum into continued economic growth both domestically and internationally. As we have already seen, one tradeoff for a rapid U.S. economic recovery has been the emergence of rising inflation that the Federal Reserve has plans to meet by raising interest rates. This could deter growth by dragging down more interest-rate sensitive industries like housing. As interest rates rise, we could begin to see a cutback in consumer and business spending that will ultimately slow the economic progress that has been made at home while simultaneously hurting emerging economies that depend on a constant U.S. dollar value.

Emerging market economies that have previously borrowed in dollars such as Turkey, a country dependent on the U.S. dollar, would be disproportionately strained by the Federal Reserve’s attempts to manage inflation as it struggles to pay foreign currency debt. As Turkey has traditionally struggled with high inflation and President Erdogan is reluctant to have higher interest rates in the hopes of encouraging growth, Turkey is at high-risk of economic hardship. While some countries have benefited from a huge uptick in American consumer demand, it is clear that the benefits have not been equal. America’s overwhelming expansion has not only put pressure on emerging market economies such as Turkey, but also has started causing supply-chain bottlenecks and other global disruptions.

As federal officials have anticipated the U.S. economy to grow 7% this year, it is evident that the U.S. will continue to play an outsized role in the global system’s economic rebound. For many low-income economies where governments have not been able to distribute vaccines to the same degree as the U.S., economic growth within the year has been revised to 2.9%. Looking into the long-term impacts of COVID-19, many emerging market and developing countries will likely continue to experience a sharp drop in investment and greater debt burdens and financial vulnerabilities. American consumers, now on more stable economic ground with an influx of stimulus cash, are driving the global economy, but some businesses are still lacking the staff and supplies necessary to serve them. As the U.S. progresses with its fast-paced recovery agenda, it is vital that we continue to act not only in our best interests but recognize the country’s position as a global economic leader that has immense influence in shaping the world economy and international trade.