Iceland, like all Arctic nations, is Drilling for Oil

Every country with Arctic waters is now actively exploring for oil in their offshore waters, or has in recent years (though Canadian exploration was halted in June over regulatory concerns). How to drill safely, sustainably, and productively in these waters is a tremendous challenge. One of the ironies of the opening of the Arctic is that the very cause of the newfound interest in Arctic oil – global warming melting the sea ice – allows even more fossil fuels to be withdrawn. That irony, however, does not mean that any of the Arctic nations will (or should) choose to ignore the potential benefits of oil exploration. While some environmentalists have called President Obama a “hypocrite” for claiming to fight climate change while allowing Arctic drilling, that overlooks the realities of today’s energy system. Until there is a sustainable, economical replacement for oil, every Arctic nation will seek to drill for oil.

Iceland provides a good example of this. Earlier this summer, I traveled to Iceland to take part in workshop jointly organized by the U.S. State Department and the Icelandic National Energy Authority (Orkustofnun) that examined Oil and Gas Sector Regulation and Long-Term Management in the Arctic. The workshop brought American regulators, business people, and subject-matter experts to Iceland to meet with and discuss how to develop a sustainable oil infrastructure. This was workshop about building an industry that was sustainable in all forms: economically, environmentally, and socially.

Iceland prides itself on its clean energy record: its electricity and heating are produced almost entirely from clean geothermal and hydro power. This energy is also remarkably cheap, due to the abundance of hydro and geothermal power. However, this abundance has not transferred to transportation – which is almost entirely dependent upon imported oil products. According to the IEA, in 2012 (the most recent year for their statistics), Iceland imported 4.8 million barrels of oil (in gasoline, jet fuel, diesel, and other refined fuel products). There are some unique aspects of Iceland’s oil use: 25% of that oil is used by Iceland’s fishing industry, and a further 20% is used for international aviation, as Keflavik airport has become a major transit route for flights. Because Iceland has such a small population, this makes it one of the largest per capita importers of oil in the world, after only Singapore.

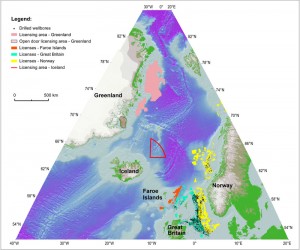

In order to try to offset that import dependence, in 2011 Iceland’s announced that a portion of its offshore economic zone would be open to oil exploration. None of the major international oil companies put forward a bid, as the “Dreki” region is an extreme frontier oil play. The winners of the bid was a consortium led by Icelandic firm Eykon Energy that includes the Chinese National Offshore Oil Company (CNOOC), the Norwegian firm Petoro, and British firm Ithaca Energy.

The geology of the Dreki (Dragon) Area is thought to be rich in hydrocarbon reserves because it is a part of the Jan Mayen Ridge, and is similar to offshore basins in East Greenland and off Western Norway that have proved to be rich in oil. Seabed samples from the area have indicated the presence of sedimentary rocks and an active hydrocarbon system. The leadership of the consortium expects seismic activity to confirm the presence of oil this year, and then exploratory activity could commence shortly thereafter.

Exploring for oil in offshore Arctic waters is challenging, but those challenges are unique to each area. Iceland’s challenges will be different than those faced by Shell in Alaskan waters. Whereas Shell has to worry about ice flows and sudden extreme weather, the Icelandic consortium will have to deal with extremely deep water and potential for deep fog banks. Fortunately, the Icelandic waters remain ice free due to the influence of the warm waters of the Gulf Stream. The challenges faced off Iceland are similar to those faced in Norway’s Arctic waters, where exploration and production has proven successful.

Each nation has to decide for itself whether the risks are worth the benefits. Iceland is a country that was battered by the financial crisis, causing a huge devaluation in its currency and racking up a mountain of debt. Perhaps this has made it especially sensitive to its import dependence on oil. The consortium claims that they expect that a moderate-sized find of 1 billion barrels would be enough to meet domestic oil demand for decades and pay off Iceland’s national debt. Against this benefit must be weighed the risks of a spill, particularly to the viability of Iceland’s fisheries – its largest export industry.

Finally, one overlooked benefit of American offshore Arctic drilling is that it gives American officials a seat at the table. One of the most valuable aspects of the workshop was that it helped build closer relations between Icelandic and American officials, both regulators and diplomats. If energy exploration was banned in American Arctic waters, then Americans would not have the standing to offer technical assistance and support to governments like Iceland or Greenland. In effect, the American government would cede the field to Chinese or Russian influence.

The nations of the Arctic are exploring for oil. Of course we should develop alternatives to oil. But, until Iceland can drive its cars, fly its planes, and operate its fishing vessels on something other than petroleum, it will seek to exploit domestic reserves of oil. The calculus is the same for the other Arctic nations.