Insuring—and Ensuring—Egypt’s Economic Future

Could insurance play a vital role in US foreign development strategies?

A report recently released by The Zurich Insurance Group, “The role of insurance in the Middle East and North Africa,” at the World Economic Forum held in Jordan highlights the potential for growth in the insurance industry in MENA and its implications for development and stability.

Given the torrent of advertisements for auto or home insurance in the US, it might seem surprising that the insurance industry has a very weak regional penetration in the Middle East and North Africa; MENA has the lowest ratio of insurance premiums written to GDP.

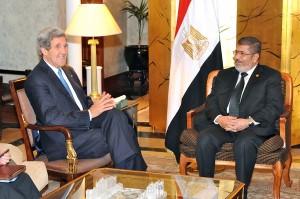

Foreign aid from the US and the IMF have reached a frustrating impasse in Egypt, as the IMF and US Secretary of State John Kerry have both voiced concerns over the Egyptian governments current economic policies and commitment to reform.

Economic indicators have worsened in the years since the revolution, with rising inflation, increased unemployment, and alarming budget concerns. Moreover, growing political instability continues to hamper the economy and discourage investment. The Supreme Constitutional Court’s ruling this weekend that the upper house of parliament was elected illegally only exacerbates that worrisome uncertainty.

The insurance industry does not offer an instant solution to the problem, but the Zurich report highlights areas that need attention and may have hampered growth in the past. The report specifies three vital effects of a strong insurance sector, namely risk transfer, risk management, and the accumulation of capital, each of which will help facilitate economic growth.

Access to insurance can also help shore up a strong middle class, another topic with which politically tuned-in Americans are all too familiar. However the issue here extends far beyond political rhetoric. As Egypt tries to modernize and pull a massive population out of widespread poverty, few safeguards exist to solidify any progress that is made. Egyptians have few ways to protect any advancement in their economic situations.

But what sort of implications does this have for US security interests, particularly in the fight against terrorism?

Strong economies have long been stressed as an important defense against extremism and terrorist activities. If people trust their government and have a stake in the state’s existence and stability, they will tend not to engage in behavior that might threaten that. Extremist organizations such as Al-Qaeda often recruit on platforms that point out foreign and local governments’ inabilities to provide for their people.

Insurance in particular frees individuals from having to depend on families or local communities, reducing regional divisions. Egypt suffers from regional disunity, especially in the Sinai, and terrorist organizations do not hesitate to exploit such divisions.

Insurance in particular frees individuals from having to depend on families or local communities, reducing regional divisions. Egypt suffers from regional disunity, especially in the Sinai, and terrorist organizations do not hesitate to exploit such divisions.

So how does this fit into the broader context of US foreign development strategies?

There is no shortage of criticism for current US foreign aid policies, with much of it pointing out that too much aid is composed of government-to-government transfers. That type of aid has little focus and even fewer measures for success.

One of the most challenging obstacles to rapid economic growth is the absence of an efficient and well-regulated financial system. It’s the circulatory system that directs cash flow, which Egypt desperately needs.

By moving US foreign aid policy away from transactional aid packages and towards developing proper institutional frameworks, agencies can help foster more sustained growth in states like Egypt. Development strategies need to include institutional know-how as much as they do pure cash, and the insurance industry seems to be a ripe area for expansion.

Significant cultural and economic challenges remain, of course.

Areas that have not had to rely on private insurance may be reluctant to embrace it. Insurance has also been largely unaffordable in the region, as noted by the Zurich report. Affordability alone though provides the US with an opportunity to get away from unfocused “packages” and direct aid to a defined, measurable goal.

While it might take more than fifteen minutes, helping the development of an insurance industry might be an integral step in assisting the sinking Egyptian economy.

[…] Insuring—and Ensuring—Egypt’s Economic Future […]