Successes and Challenges to Chinese Clean Energy Development

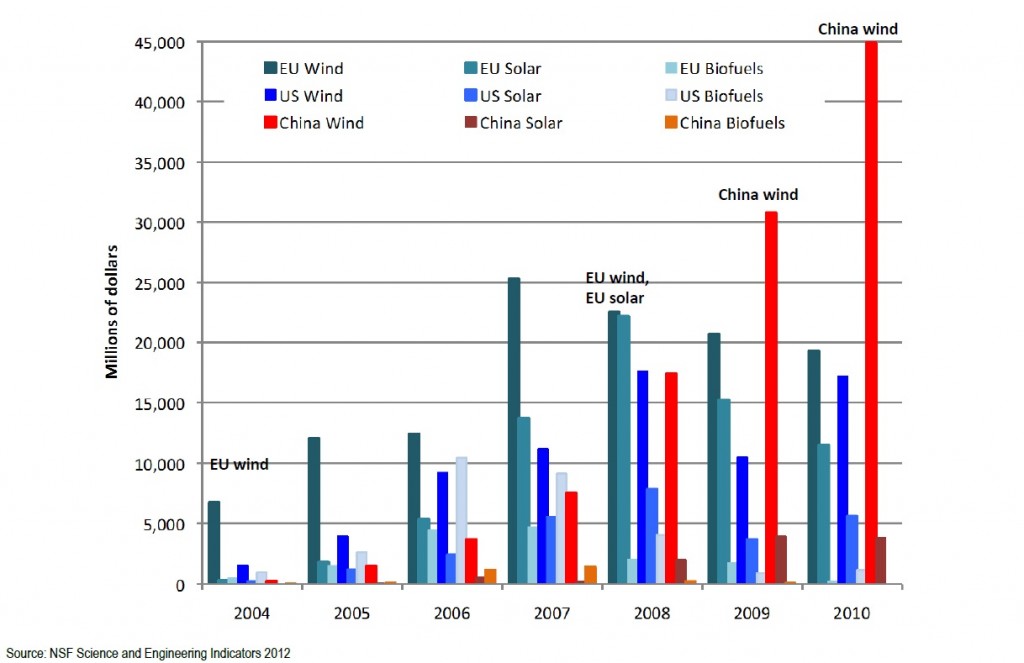

In 2011, China surpassed the U.S. in installed renewable energy capacity, with an astonishing 92% growth in from 2006 to 2011. Although still the world’s biggest emitter of greenhouse gases, China is also the world’s greatest consumer of clean energy.

In a briefing on October 12th called Why China Is Acting on Clean Energy: Successes, Challenges, and Implications for U.S. Policies, the Environmental and Energy Study Institute collaborated with the ChinaFAQ Project, of the World Resources Institute (WRI) to talk about clean energy in China and ongoing trade disputes between the United States and China. The panel consisted of Joanna Lewis, Assistant Professor at Georgetown University; Ailun Yang, Senior Associate, WRI; Stephen Munro, Policy and International Analyst, Bloomberg New Energy Finance; and Bob Simon, Staff Director, Senate Committee on Energy and Natural Resources.

In a briefing on October 12th called Why China Is Acting on Clean Energy: Successes, Challenges, and Implications for U.S. Policies, the Environmental and Energy Study Institute collaborated with the ChinaFAQ Project, of the World Resources Institute (WRI) to talk about clean energy in China and ongoing trade disputes between the United States and China. The panel consisted of Joanna Lewis, Assistant Professor at Georgetown University; Ailun Yang, Senior Associate, WRI; Stephen Munro, Policy and International Analyst, Bloomberg New Energy Finance; and Bob Simon, Staff Director, Senate Committee on Energy and Natural Resources.

A driving factor of China’s push for clean energy is the declining profitability of coal. Ms. Yang stated that in 2011, nearly all coal plants in China lost money doing business. The price freeze that the Chinese government placed on the power sector immensely benefits customers but at the cost of coal plants seeing greater losses each year. As a result, investment in coal has dipped.

Another reason China wants to shift to cleaner energy is the rising public unrest over the health hazards of coal. Local pollution is a serious problem in many Chinese cities, and public outrage has motivated Chinese leaders to seek cleaner alternatives. The new Five-Year Plan (FYP) also prioritizes “new energy” as a strategic and emerging industry.

Coal will continue being a mainstay in China’s energy mix going forward because it makes up 80% of total electricity generation today; that won’t be shut off tomorrow. However, the new FYP will strongly support clean energy development with the objective of reducing the share of energy used that comes from coal.

China has begun switching from being mainly an exporter of renewable energy technology towards becoming a more active consumer. The 12th FYP aims to have more than 100 Gigawatts (GW) of installed wind capacity and more than 20 GW of installed solar capacity by 2015. This will be a huge increase over 2011 levels, which stood at 64 GW for wind and 2.3 GW for solar.

For both China and the U.S., upgrading transmission capacity to better integrate renewables is an urgent priority. For example, wind energy already poses problems to the Chinese grid because of fluctuations in electrical output, so much so that not all wind towers are connected to the grid. In fact, the Chinese Wind Energy Association estimates that electricity enough for 3 million people went to waste in 2011 because functioning wind towers weren’t connected to the grid.

Before China builds anymore wind farms, updating its electric infrastructure is an absolute necessity. Mr. Simon noted that China has an incredible opportunity to revamp its grid relatively easily since their grid is still fairly under-developed. In the U.S. this is a lot trickier since the grid is much older and decentralized.

Another challenge facing the Chinese clean energy industry is the array of on-going trade disputes with the U.S. and E.U. This year the U.S. Department of Commerce issued new tariffs on Chinese solar cell imports of up to 36% and the E.U. also launched anti-dumping investigations against China.

Mr. Munro described the situation as a “global network of trade disputes” and he predicts that both the U.S. and China will levy duties against each other. It is a complex environment, with both China and U.S. investigating unfair trade practices by the other and yet at the same time uniting against the E.U’s aviation carbon emissions limits.

The duties that the U.S. and China would likely levy on each other will only serve to make renewable energy less affordable. The decline in solar module prices, for example, will likely slow as a result.