Tight Oil Gives West Leverage Over Iran

Chief among the geopolitical consequences of the U.S. tight oil boom is the greater leverage it gives Western powers over Iran. OECD nations and emerging markets most dependent on Iranian oil—Turkey, Japan, South Korea, India, and China—can reduce their imports with greater certainty that the world market will remain loose. Supplies traditionally directed to the U.S. are being rerouted because of lowering demand for imports there.

The most recent U.S. and E.U. sanctions levied against Iran (H.R. 1905, H.R. 850) targeted the Iranian energy sector, including: the state oil company, and shipping, tanker, and port concerns. The E.U. boycotted Iranian oil completely in July, 2012, and canceled insurance on tankers that carry Iranian oil. The regime, already resorting to underhanded methods of getting its product to market, is losing the struggle. Oil production is also dropping precipitously as the state lacks funds to improve and expand operations upstream.

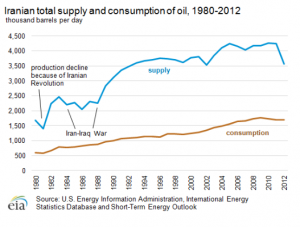

The trend is clear in a recent EIA chart (below) showing a sudden decline in oil supply between 2011 and 2012. Given the EU boycott and falling exports to major consumers like China, India, and Japan, the near term looks grim for an Iranian regime that derives over 50% of its revenue from oil and petrochemicals. How the newly elected President and Supreme Leader will respond is still unclear, but the severe economic consequences of pursuing a non-transparent nuclear program are becoming most evident.

[…] Tight Oil Gives West Leverage over Iran […]

[…] had several short-term geopolitical effects. It has provided some breathing room to allow tougher sanctions on Iran. It has reduced the revenues and influence of OPEC. It has also added some spare capacity to global […]

[…] the United States and the European Union to marshal the international community to implement sanctions on Iran. The sanctions targeted Iran’s energy sector specifically, successfully curtailing Iranian oil […]

[…] Tight Oil Gives West Leverage over Iran […]